The gross operating income, for example, should not be incorrectly rounded or estimated, as this would give a false NOI calculation. The accuracy of an NOI calculation is wholly dependent on the right components being used in its calculation. Including Mortgage Payments And Taxes In The Noi Calculation Although mortgage payments and taxes are not considered operating expenses, they can be included in the NOI calculation.

Are mortgage payments included in noi calculation professional#

In terms of operating expenses, these aren’t only maintenance fees, but everything from insurance to professional help. Cap rate is not a metric of return on a specific asset. And to calculate investment returns relative to your cash investment, you must use either COC or IRR, of which IRR is much more dynamic.

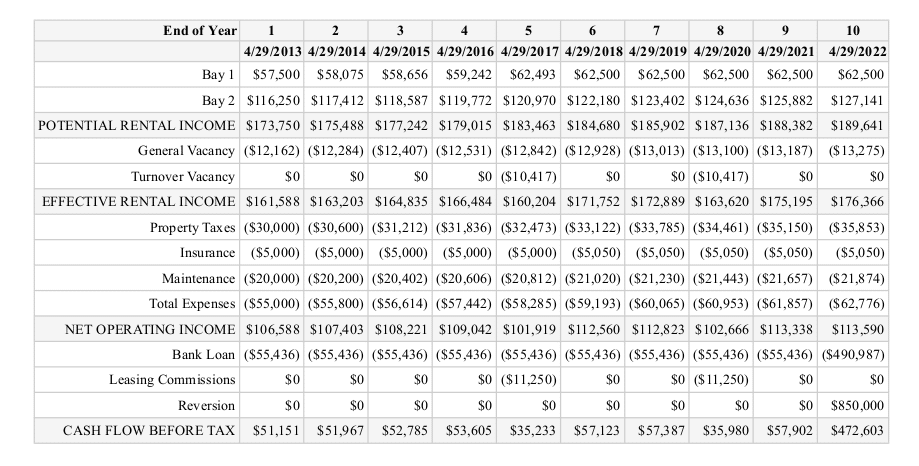

The total income of a property comes from various sources such as tenant rents, parking fees, coin laundry machines, etc. The NOI provides Net operating income (NOI) is a vital real estate profitability metric to help you calculate an investment propertys potential revenue. Of course, the debt service, whenever there is debt, must be subtracted from the NOI in order to arrive at the cash flow.

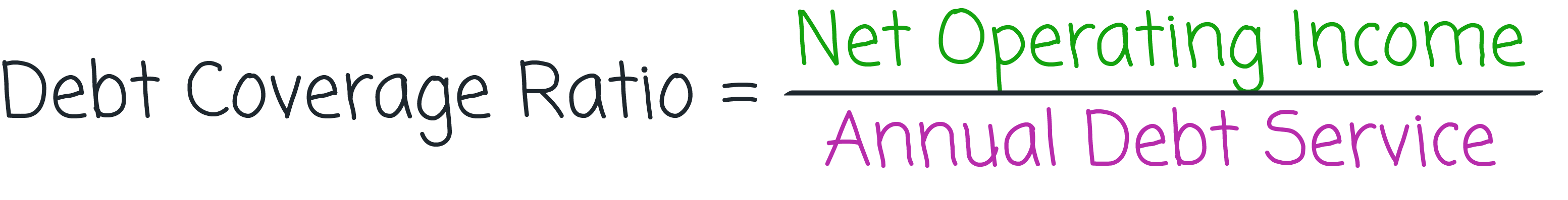

NOI can only be properly calculated when all income that a property makes is taken into consideration, and all of the general expenses accrued during operation are subtracted. (Gross Operating Income + Other Income) - Total Operating Expenses = Net Operating Income

0 kommentar(er)

0 kommentar(er)